Financial Trends for Smart Investing

Discover the latest financial trends shaping smart investing, from tech innovations to sustainable investments and market dynamics.

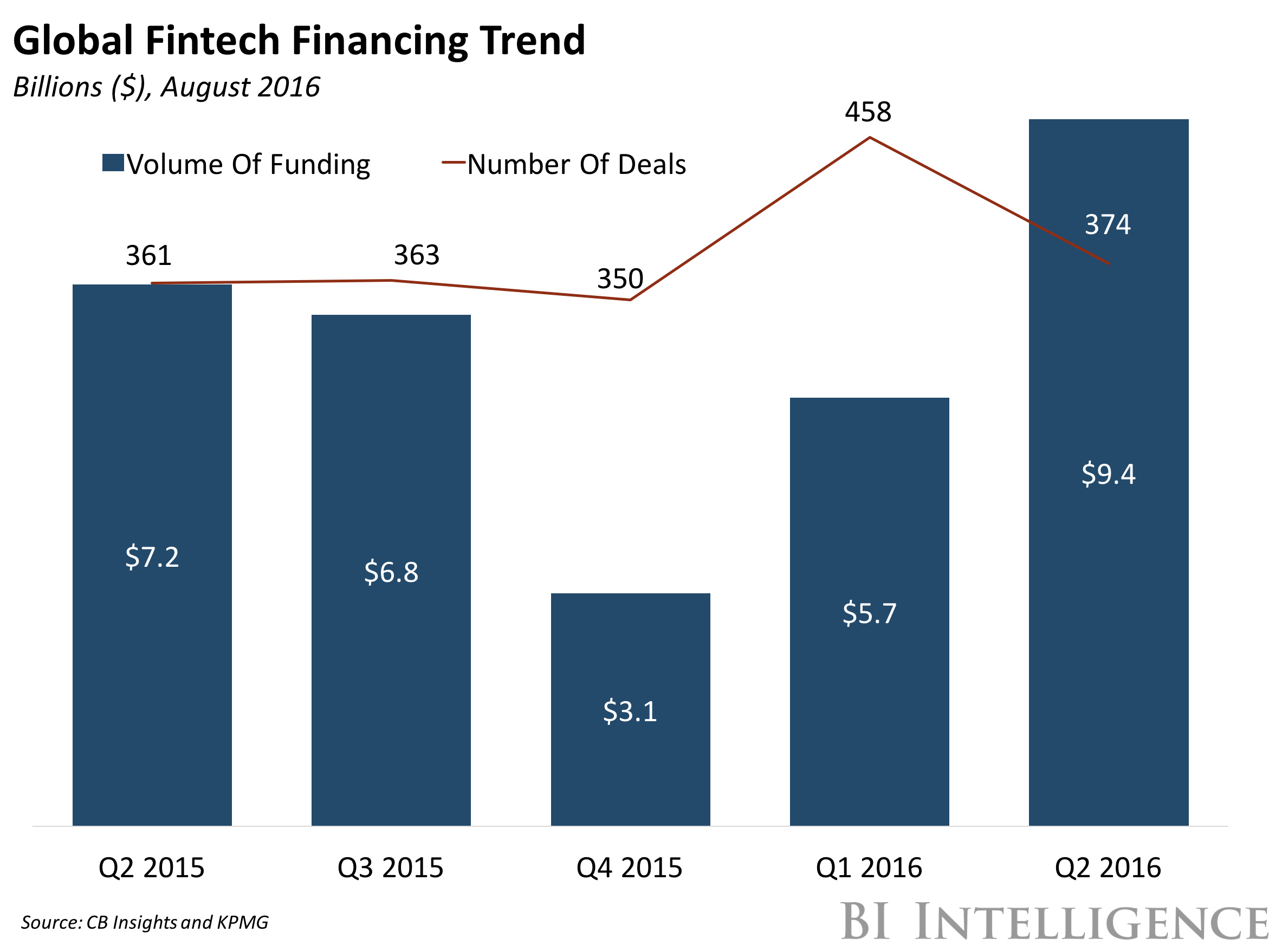

The Rise of Technology in Finance

The integration of technology in finance has revolutionized the investment landscape. Automated trading systems, robo-advisors, and blockchain technology are becoming commonplace. Investors now have access to real-time data and advanced analytical tools that were once only available to large financial institutions. This democratization of information enables individual investors to make more informed decisions. Moreover, fintech innovations are reducing transaction costs and increasing market efficiency. As technology continues to evolve, its impact on financial markets will likely grow, offering both opportunities and challenges for smart investors.

Sustainable and Ethical Investing

Sustainable and ethical investing is gaining traction among investors who are increasingly concerned about the social and environmental impact of their investments. Funds that focus on Environmental, Social, and Governance (ESG) criteria are attracting significant inflows. These investments not only aim to generate financial returns but also promote positive societal outcomes. Companies with strong ESG practices are often viewed as more resilient and better managed, making them attractive long-term investments. As awareness and demand for responsible investing grow, it is likely that ESG-focused funds will continue to play a significant role in the financial markets.

The Importance of Diversification

Diversification remains a fundamental principle of smart investing. By spreading investments across various asset classes, sectors, and geographies, investors can reduce risk and enhance potential returns. Diversification helps mitigate the impact of poor performance in any single investment. For example, if one sector experiences a downturn, gains in another sector can offset the losses. While diversification does not guarantee profits or protect against all losses, it is a crucial strategy for managing risk. Investors should regularly review and adjust their portfolios to ensure they remain well-diversified.

The Role of Interest Rates

Interest rates play a critical role in financial markets and can significantly influence investment decisions. Central banks use interest rates to control inflation and stabilize the economy. When interest rates are low, borrowing becomes cheaper, which can stimulate economic growth and boost asset prices. Conversely, high interest rates can slow down economic activity and negatively impact investment returns. Investors need to stay informed about interest rate trends and understand how changes can affect different asset classes. For example, rising interest rates can lead to lower bond prices, while potentially benefiting financial stocks.

The Impact of Globalization

Globalization has interconnected economies and financial markets around the world. This interconnectedness means that events in one part of the world can have significant ripple effects elsewhere. For smart investors, understanding global trends and their potential impacts is crucial. For instance, trade agreements, geopolitical tensions, and economic policies in major economies can influence global markets. Diversifying investments internationally can provide exposure to growth opportunities outside the domestic market. However, it also introduces additional risks, such as currency fluctuations and political instability, which investors need to manage carefully.

Behavioral Finance and Investor Psychology

Behavioral finance examines how psychological factors influence investor behavior and market outcomes. Emotions such as fear and greed can lead to irrational decision-making, causing investors to buy high and sell low. Understanding common biases, such as overconfidence, herd behavior, and loss aversion, can help investors make more rational decisions. For example, being aware of the tendency to follow the crowd can prevent impulsive investment choices. By recognizing and managing these psychological factors, investors can improve their decision-making process and enhance their investment performance.

The Importance of Continuous Learning

The financial markets are constantly evolving, making continuous learning essential for smart investing. Staying updated with the latest trends, economic indicators, and market developments can provide a competitive edge. Investors should seek out reliable sources of information, such as financial news, market analysis, and educational resources. Additionally, learning from past investment experiences and mistakes can lead to better future decisions. Engaging with investment communities, attending seminars, and taking courses can also enhance financial literacy. By committing to continuous learning, investors can adapt to changing market conditions and make informed investment choices.